or those of you who don’t follow economics, or are too young to recall the political events of 2011 and 2013, the term “debt ceiling” refers to a statutory limit on how much the U.S. government can borrow. Ironically, Congress introduced the ceiling, more than a century ago, with the intention of making it simpler for the government to issue debt. For decades, it was increased regularly without much ado, but in the modern era it has been transformed by Republicans into a political weapon. When they are in power, they largely ignore it, concentrating on cutting taxes for the wealthy, bloating the budget deficit, and issuing mountains of public debt. (During the Trump Administration, more than roughly seven trillion dollars of additional debt was created, with much of it taking place during 2020, after the coronavirus pandemic began.) When Democrats occupy the White House, Republicans use the debt ceiling to demand spending cuts, and to hold the government, and the country, for ransom.

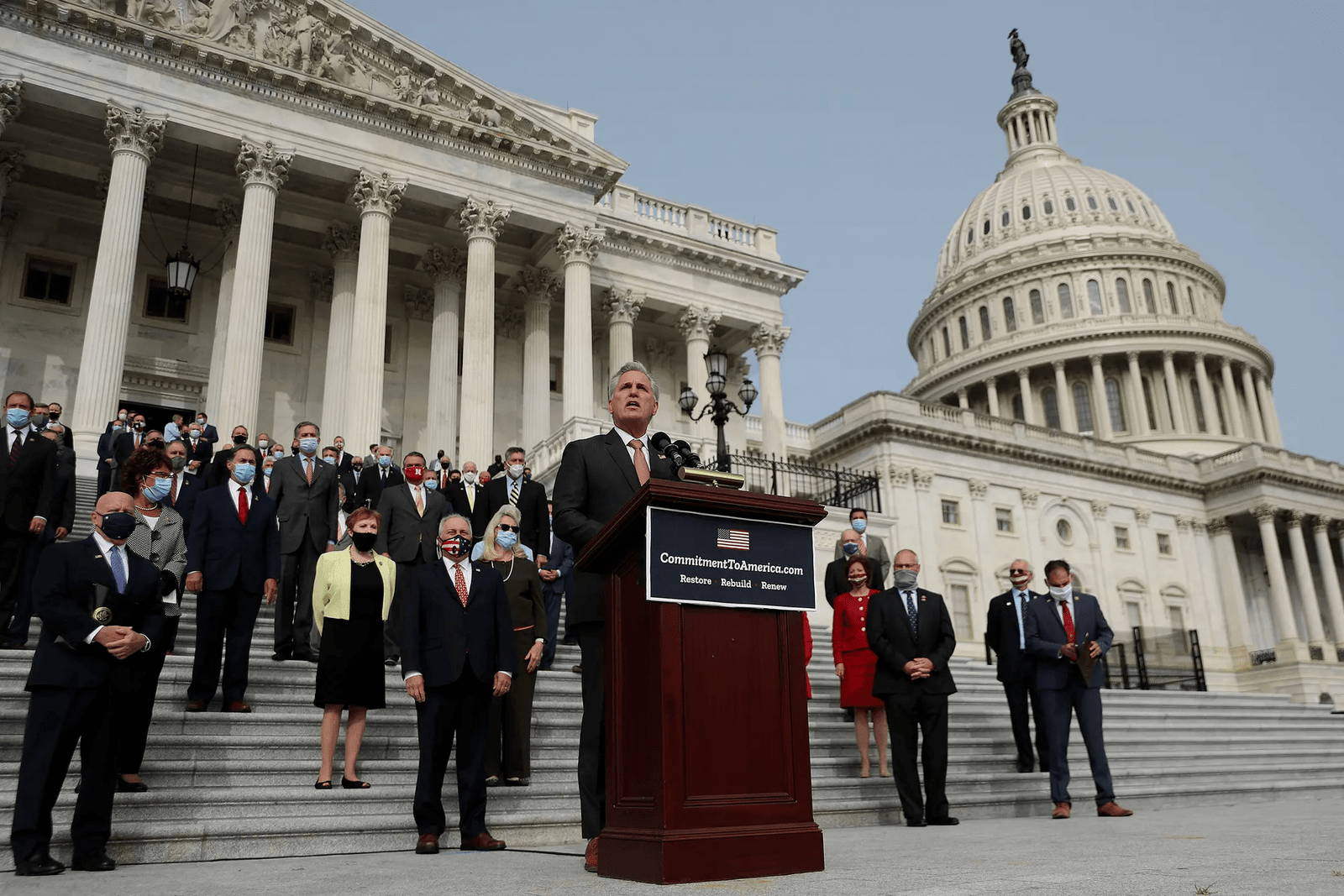

This last time Congress raised the ceiling was in December, 2021, when Democrats had a majority in both chambers. Now that Republicans control the House, they are threatening to prevent another increase unless their demands for broad cutbacks are met. As part of the Faustian pact that the Republican leader Kevin McCarthy made with members of the right-wing Freedom Caucus to be elected Speaker, he reportedly agreed to tie raising the ceiling to reducing federal spending.

Be the first to know when John Cassidy publishes a new piece.

The latest on politics and the economy.

By signing up, you agree to our User Agreement and Privacy Policy & Cookie Statement.

Last Friday, Treasury Secretary Janet Yellen sent a letter to Congress in which she said that the U.S. government will hit the statutory borrowing cap on Thursday, meaning that the Treasury Department “will need to start taking certain extraordinary measures to prevent the United States from defaulting on its obligations.” This doesn’t imply that the U.S. is about to follow in the steps of countries such as Argentina and, most recently, Ghana, that have been forced to renege on their bonds. As Yellen intimated, the Treasury can delay a default by employing some legitimate but unusual financial tactics, such as redeeming existing investments of federal-employee pension plans, and suspending new ones. This strategy should be sufficient to tide Uncle Sam over to the summer. Nonetheless, reaching the borrowing cap does mark the beginning of another needless and heedless political showdown. As Gregory Daco, the chief economist at EY-Parthenon, put it to me: “We are on course to end up in another game of chicken.”

In a note issued on Tuesday, Daco warned that the debt-ceiling drama could have dire economic consequences. If the U.S. government did breach the ceiling, he pointed out, it would be unable to issue any additional debt and would have to immediately slash spending far enough so that it was covered by revenue—a cut of up to a trillion dollars on an annual basis. “This would mean an instantaneous cut to spending worth around 4.5-5.0% of GDP, leading to a self-inflicted recession and risking severe financial market dislocations,” Daco wrote. And, he told me, well before such a calamitous outcome were to materialize, stocks, bonds, and the dollar could be vulnerable to sell-offs as investors begin to take the threat seriously. “You would start to see increased financial volatility, and, essentially, a front-running of the debt-ceiling breach.”

To be sure, a bad outcome isn’t certain. At least in theory, there’s still plenty of time—at least five months—for Congress to avert a crisis. For now, the financial markets seem relatively unconcerned. In fact, since the start of the year, the prices of Treasury bonds have risen, which has led to a fall in yields—the opposite of what you’d expect in a crisis of confidence. Investors seem to be assuming that, one way or another, the debt ceiling will be raised before economic disaster strikes. Wall Street could be right. But there are at least two reasons why it could be wrong.

The first, and more important one, is that the radicals in the House Republican caucus now have an effective veto on anything McCarthy does, and they are determined to hold him to the promises he made to them. It emerged last Friday that McCarthy pledged, among other things, to pass a bill in the House that would commit the Treasury Department, in the event of a breach in the ceiling, to prioritize certain spending, including interest payments on the national debt. “We agreed to advance a debt prioritization bill through regular order by the end of the first quarter of 2023,” Chip Roy, a Texan member of the Freedom Caucus, told the Washington Post. Since the Democrats control the Senate and the White House, there is no chance of such a bill becoming law, but its passage would be a demonstration of intent.

On the other side of the aisle, congressional Democrats and the White House are insisting that they won’t negotiate over the debt ceiling. On Tuesday, Karine Jean-Pierre, the White House press secretary, re-stated this position. “This is just another attempt by congressional Republicans to force unpopular cuts on programs critical to seniors, the middle class, and working families,” she said. She also described the idea of passing a bill that prioritizes certain payments as “a recipe for economic catastrophe.” Many economists, including even some Republican analysts, concur.

Behind the Democrats’ refusal to negotiate is a righteous anger over the House Republicans’ embrace of financial terror tactics, but there are also political considerations. Many Democrats recall getting burned during the 2011 debt-ceiling standoff, when the Obama Administration did negotiate with Republicans. The haggling eventually led to the adoption of a budget sequester that involved significant spending cuts, which, arguably, held back the economy and damaged Democratic prospects in 2016. Also, right now, some Democrats relish the prospect of leaving the field open for Republicans to publicly countenance a debt-ceiling breach and propose cuts to entitlement programs. “As a Democratic political strategist, I have to confess that part of me is looking forward to seeing Republicans demanding cuts in Social Security and Medicare,” Jim Manley, who worked as senior Democratic staffer on Capitol Hill for more than two decades, told me.

In this charged environment, a large amount of theatrics seems inevitable, and that, at some point, is likely to rattle the financial markets. The big unknown is: What will happen then? Although most people are focussing on the House, Manley, who used to work for Senator Harry Reid, suggested that Mitch McConnell, the Senate Majority Leader, could eventually emerge as a key player, and a possible interlocutor with senior Democrats. “Will he start maneuvering behind the scenes to prevent a disaster?” Manley asked. “His modus operandi is light fingerprints and only acting at the last moment.”

Yet, even if Republican and Democratic leaders could agree on a last-ditch deal to raise the debt ceiling, would Roy and his colleagues in the Freedom Caucus go along with it? “My concern is that, even after all the Kabuki theatre, the Republican die-hards in the House are still going to demand things that are unacceptable,” Manley said. “They want to burn the place down.”

Largely for this reason, some Democrats and media observers are floating unorthodox ways to work around the Republican enragés. These options include President Biden unilaterally raising the ceiling by invoking the Fourteenth Amendment, which says, “The validity of the public debt of the United States . . . shall not be questioned”; or having the Treasury Department mint a platinum coin with a face value of a trillion dollars and using it to avert a default. Another possibility is to get some more moderate House Republicans to support a “discharge petition,” a rarely used parliamentary maneuver that would force McCarthy to allow a floor vote on raising the ceiling.

Felecia Phillips Ollie DD (h.c.) is the inspiring leader and founder of The Equality Network LLC (TEN). With a background in coaching, travel, and a career in news, Felecia brings a unique perspective to promoting diversity and inclusion. Holding a Bachelor’s Degree in English/Communications, she is passionate about creating a more inclusive future. From graduating from Mississippi Valley State University to leading initiatives like the Washington State Department of Ecology’s Equal Employment Opportunity Program, Felecia is dedicated to making a positive impact. Join her journey on our blog as she shares insights and leads the charge for equity through The Equality Network.

Localize por meio do software de sistema “Find My Mobile” que acompanha o telefone ou por meio de software de localização de número de celular de terceiros.