Under the Biden administration, wealthy tax cheats can no longer count on getting the “audit lite” treatment.

The Internal Revenue Service last week announced a crackdown on writing off the personal use of corporate jets as a business expense. Taking improper tax deductions for private jet flights is the newest target of a reinvigorated IRS, which, under the Biden administration, has begun aggressively pursuing wealthy tax cheats.

The IRS said it would also increase examinations of partnerships—another area where cheating has long been rampant—and in general will scrutinize more returns filed by people making more than $1 million per year, especially if they owe large tax debts, own multiple shell companies, or have overseas bank accounts.

These new audit policies clearly signal to business owners and executives that the Trump-era practice of looking the other way at high-level tax cheating is over. The IRS said that the rate at which the IRS audits poor, middle-class, and upper-middle-class Americans will not change.

This is welcome news for honest taxpayers, because when those with the highest incomes cheat, everyone else must pick up their burden in one of three ways: They pay more taxes, receive less government services, or bear the interest on increased government borrowing.

Danny Werfel, the Biden administration’s commissioner of Internal Revenue, said that the IRS is “concerned people are using business aircraft for personal use, and in turn, then taking the business deduction they may not be fully entitled to.”

While corporate jet abuse can involve tens of millions of dollars in improper write-downs and improper deductions for operating costs, that issue is primarily symbolic, a law enforcement tactic known as “general deterrence.” The aim is to catch the attention of big-name tax cheats so that they change their behavior lest they get caught and punished with fines or even prison time. Expect at least one high-profile civil prosecution over private jet tax deductions to drive home the point—followed by grumbling from pro-corporate politicians that enforcing the tax laws is oppressive.

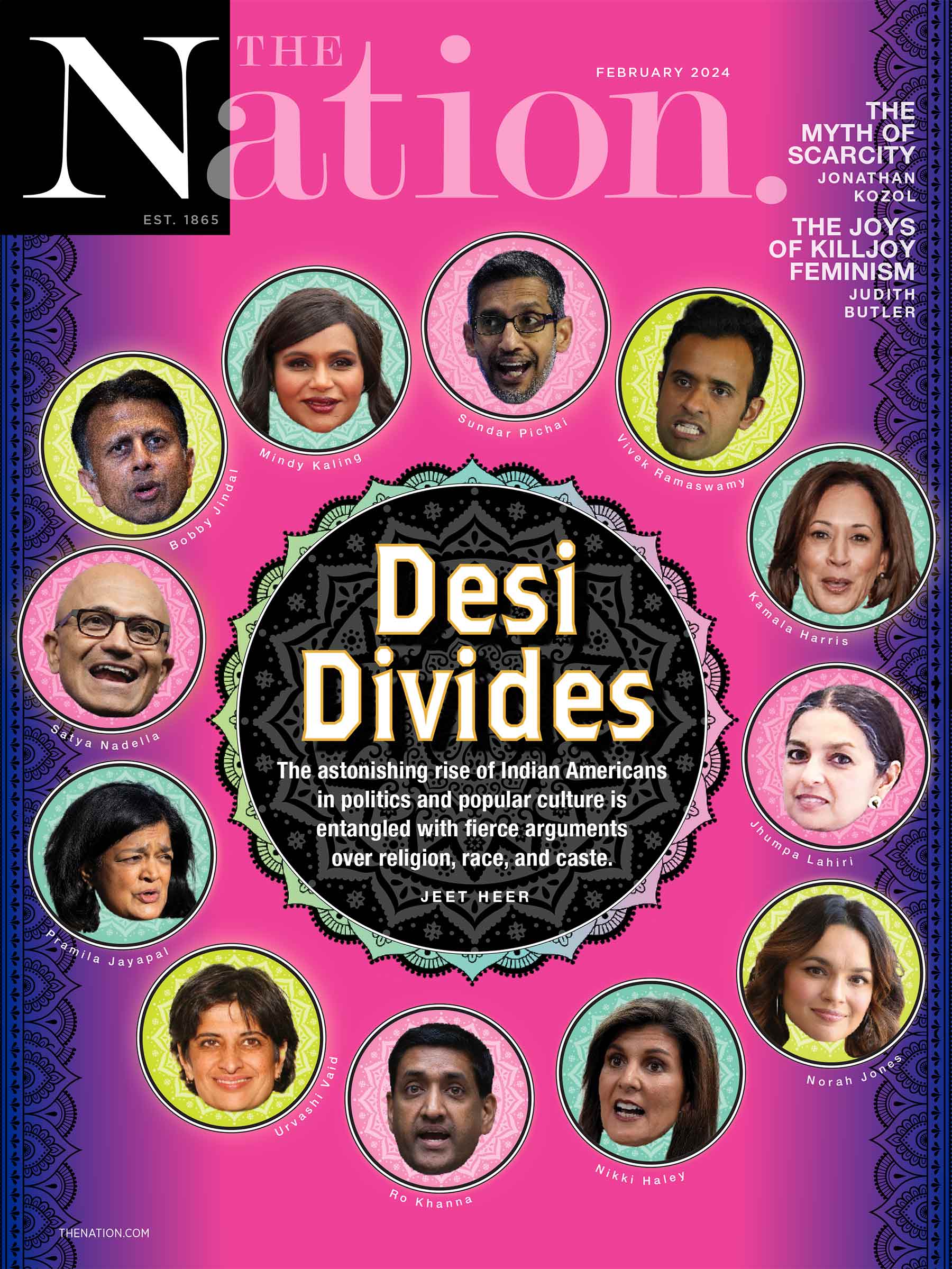

Current Issue

According to Werfel, the money lost to cheating by millionaires and billionaires totals about $150 billion each year. Collecting that would increase federal income tax revenue by more than 6 percent.

Many tax experts believe that the official estimate of high-end cheating is conservative. Indeed, Charles Rettig, the Beverly Hills tax avoidance lawyer who headed the IRS under Donald Trump, told Congress three years ago that, overall, “it would not be outlandish to believe that the actual tax gap could approach, and possibly exceed, $1 trillion per year.” This year, individual and corporate income tax revenue should total $3 trillion.

Tax cheating became almost risk-free for the wealthiest Americans during the Trump years. The 755 largest corporations also got a pass, their audit rate halved, IRS data shows. The amount of extra tax auditors found fell even more.

Consider tax returns filed by people reporting income of $10 million or more in 2016, the last year of the Obama presidency, and 2020, Trump’s last year as president. The number of these very-high-income households tax shot up 65 percent from 16,097 in 2016 to 26,517 under Trump. But the number of completed audits plummeted 92 percent to just 80. That’s just 0.03 percent.

Counting both completed audits and those in process, as the IRS urges journalists to do, shows a nearly 70 percent decline in the audit rate, hardly any better.

The quality of these audits also fell, so much so that additional taxes recommended by IRS auditors fell 98 percent.

To put that in perspective, the highest-paid IRS auditors make less than $100 per hour but find more than $13,000 of taxes owed for each hour they work on these high-income tax returns, a new Government Accountability Office study found.

The tiny number of high-income tax returns that the IRS did audit largely received once-over-lightly examinations. These were not deep dives to untangle sophisticated accounting tricks or to uncover nonexistent shell companies used to fabricate tax deductions and hide income. Some IRS auditors call this, in a mocking reference to weak beer, “audit lite.”

The Americans audited most often are the working poor who take advantage of the earned income tax credit, the primary federal program to alleviate child poverty. Their audit rate is more than five times that of the general population, according to the Transactional Records Access Clearinghouse at Syracuse University, which gathers raw government data and makes sense of it for citizens.

The high audit rate for the working poor began under a 1994 deal between President Bill Clinton and Newt Gingrich, who became House speaker. Many Republican lawmakers favor these high audit rates, saying that the anti-poverty tax credit is rife with fraud. However, research by the IRS’s taxpayer advocate found that most issues involve math errors, estranged parents both claiming a child, and what the advocate says are unnecessarily complex rules.

(Congress created the taxpayer advocate position in 1996 at the urging of Republicans who complained that no one at the IRS spoke for taxpayers. Since then, Congress has largely ignored the annual recommendations of the advocate, currently Erin M. Collins.)

The Biden administration’s new policy targeting wealthy tax cheats won’t transform the federal tax system overnight. After many years of minuscule or nonexistent pay raises and relentless antagonism from Congress, the total number of auditors is down 43 percent since 2010.

Popular

“swipe left below to view more authors”Swipe →

Cheating among those who earn more than $1 million a year often involves sophisticated accounting tricks. Uncovering these devices requires tax auditors with advanced degrees in accounting and law who understand excessively complicated rules and can determine whether business subsidiaries are actual or fictitious.

“It’s going to take time to gear up…to audit high-income folks,” said Sue Long, a Syracuse University statistics professor who has studied IRS operations for decades.

The sharp decline in enforcing tax law began during the Clinton administration. It accelerated after Trump appointed Rettig, whose law practice represented tax avoiders and suspected tax cheats. I wrote in 2018 that “Trump’s pattern of putting foxes in charge of the henhouse continues” with his choice of Rettig to head the IRS.

Under Rettig, the IRS withheld some routine statistical data from the public while insisting there was no attempt to hide evidence of lax law enforcement. But the data got out anyway because the IRS had to give it to Long under a federal court order she obtained in 1976.

Trump is among those high-income Americans whose tax cheating may now come under scrutiny. Letitia James, the New York State attorney general, just referred Trump to the IRS for investigation based on evidence that emerged during the civil fraud trial where he was ordered to pay more than $450 million in ill-gotten gains and interest.

Among other tricks, Trump is known to create fictitious businesses with fabricated deductions—which should be a risky strategy, but is one that IRS auditors have told me others have also used to escape taxes they owe.

The tax information released by House Democrats last year showed that Trump’s tax returns included five dozen businesses, known as Schedule C sole proprietorships.

These businesses showed little or no income over five years, yet Trump routinely took deductions for them. Some of these filings balanced revenue and deductions precisely, resulting in zero profit. Every tax accountant, lawyer, and professor I interviewed declared that it was so unlikely that revenue and expenses would be exactly equal that the filings should not be trusted.

That Trump persisted in claiming fictitious business expenses is particularly brazen because auditors caught him doing the same thing in 1984. Trump insisted he was entitled to take more than $600,000 in business expenses, despite having no revenue and no receipts. Eight years later, the city and the state of New York tried Trump for civil tax fraud. Like most tax proceedings, no reporter covered them at the time and the story remained unknown until my daughter Amy found records showing that Trump lost both cases—a story I broke in 2016.

At one of his fraud trials, Trump’s longtime tax lawyer and tax accountant Jack Mitnick testified that, though his signature was on the tax return, neither he nor his firm prepared that return or the filing for the imaginary business. The issue arose because the signature had been applied with a photocopier instead of Mitnick’s name appearing in ink, known as a wet signature.

Trump was lucky he wasn’t prosecuted for forgery and lying under oath.

Since two judges informed Trump in harsh language that what he did in 1984 was illegal, the IRS could build a strong case for criminal tax fraud because of those five dozen fictitious businesses. I’ve recommended that Alvin Bragg, the Manhattan district attorney, prosecute Trump for tax fraud, because proving he acted with criminal intent would be easy.

President Joe Biden’s Inflation Reduction Act financed the recent dramatic and long overdue shift to stricter tax law enforcement. That 2022 law provides nearly $80 billion in additional funding for the federal tax police spread over the next 10 years.

Support for more tax law enforcement has been growing even among those known for their anti-tax stances. Alex Muresianu, a senior policy analyst at the anti-tax Tax Foundation, recently wrote, “There is a compelling case for strengthening the enforcement of existing taxes, rather than creating new ones, as a way to raise revenue.” He noted that simplifying the tax code would also make enforcement more manageable and effective.

Thank you for reading The Nation!

We hope you enjoyed the story you just read. It takes a dedicated team to publish timely, deeply researched pieces like this one. For over 150 years, The Nation has stood for truth, justice, and democracy. Today, in a time of media austerity, articles like the one you just read are vital ways to speak truth to power and cover issues that are often overlooked by the mainstream media.

This month, we are calling on those who value us to support our Spring Fundraising Campaign and make the work we do possible. The Nation is not beholden to advertisers or corporate owners—we answer only to you, our readers.

Can you help us reach our $20,000 goal this month? Donate today to ensure we can continue to publish journalism on the most important issues of the day, from climate change and abortion access to the Supreme Court and the peace movement. The Nation can help you make sense of this moment, and much more.

Thank you for being a supporter of independent journalism.

More from

David Cay Johnston

If we want to address the inequality crisis, we must prevent corporations from sitting on hoards of untaxed cash.

David Cay Johnston

Obama and Congress must get tougher on offshore tax cheats–prosecuting them as criminals and requiring full payment, with penalties and interest.

Editorial

/

David Cay Johnston

There’s still plenty of time for the media to get the bailout story right: just start asking, “Who benefits?”

Editorial

/

David Cay Johnston

Felecia Phillips Ollie DD (h.c.) is the inspiring leader and founder of The Equality Network LLC (TEN). With a background in coaching, travel, and a career in news, Felecia brings a unique perspective to promoting diversity and inclusion. Holding a Bachelor’s Degree in English/Communications, she is passionate about creating a more inclusive future. From graduating from Mississippi Valley State University to leading initiatives like the Washington State Department of Ecology’s Equal Employment Opportunity Program, Felecia is dedicated to making a positive impact. Join her journey on our blog as she shares insights and leads the charge for equity through The Equality Network.

What i dont understood is in reality how youre now not really a lot more smartlyfavored than you might be now Youre very intelligent You understand therefore significantly in terms of this topic produced me personally believe it from a lot of numerous angles Its like women and men are not interested except it is one thing to accomplish with Woman gaga Your own stuffs outstanding Always care for it up

Impressed by your knack for closing deals; your approach on team projects is truly admirable!

My brother recommended I might like this web site He was totally right This post actually made my day You cannt imagine just how much time I had spent for this information Thanks

Positivity resembling a successful omnichannel strategy – reaching people in various meaningful ways.

Wow superb blog layout How long have you been blogging for you make blogging look easy The overall look of your site is magnificent as well as the content

Dedication making a significant impact, much like a successful influencer marketing campaign.

Somebody essentially lend a hand to make significantly articles Id state That is the very first time I frequented your website page and up to now I surprised with the research you made to make this actual submit amazing Wonderful task

I loved as much as youll receive carried out right here The sketch is attractive your authored material stylish nonetheless you command get bought an nervousness over that you wish be delivering the following unwell unquestionably come more formerly again as exactly the same nearly a lot often inside case you shield this hike